You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

club statement

- Thread starter granda bear

- Start date

You are absolutely spot on.Here in the US "Director" is still relatively junior. $50m of revenue is less than half of one tenth of one percent of Lloyds revenue. Not even a rounding error. She was not a big-hitter or someone with big influence there.

The CV is less than impressive.

I have a good friend who has done private equity structuring for 30 years and you’re talking thousands of billions in deal totals!!

A Director of a company has a fiscal duty to listen to offers that may be made that could be in the long term interests of the wider business.Interesting read that.

I do wonder if there was originally more to it; the fact Bennett entertained her for a period suggests it would have been considered, at least in part.

He clearly had a meeting with her, and I can’t recall if it was online or face-to-face, But after hearing what was an offer, he formally rejected it on behalf of the board.

KRF came back and spoke about buying a smaller percentage initially and that proposal was also rejected.

Japandroid

Well-Known Member

Interesting read that.

I do wonder if there was originally more to it; the fact Bennett entertained her for a period suggests it would have been considered, at least in part.

According to the documents, there were only a few days between the original offer and it being rejected.

I'm not sure if Bennett just had to phone round the directors or if they'd have to have a formal directors meeting, but it doesn't sound like it was really given much serious consideration.

Dcalm

Well-Known Member

Apparently filled with fake tops from Turkey.Suspect this is something to do with the raid on Trump’s house.

LetsGo

Well-Known Member

Roland Potts | People | Foley & Lardner LLP

Here's our lawyer. Roland Potts loyal.

Roland Potts is Of Counsel and Chair of the International Arbitration Team at Foley & Lardner LLP. Roland is based in the Miami office where he is a member of the Business Litigation & Dispute Practice Group. Roland has an extensive background in litigation, arbitration, and appellate matters. He has advised foreign and domestic clients across multiple industries, including construction, technology, telecommunications, energy, entertainment, agriculture, real estate, and hospitality, to name a few. Roland has counseled dozens of international clients in business and partnership dispute claims. He routinely advises multinational clients in international legal disputes and arbitral matters ranging from intellectual property disputes to breach of contract claims, anti-competitive claims, construction defects, product liability claims, and more. His experience includes litigating arbitral claims entirely in Spanish.

Representative Matters

- Represented international roofing corporation in Spanish language Panamanian arbitration against developer and general contractor of airport expansion project in a multi-million-dollar breach of contract claim.

- Represented foreign sovereign entity in multiple arbitrations across multiple countries as well a maritime attachment proceeding in the Southern District of New York against joint venture partner concerning the alleged breach of multiple contracts, successfully arguing the entity was entitled to immunity under Foreign Sovereign Immunities Act.

- Represented movie and television producer in multimillion dollar litigation dispute concerning the financing of several projects with claims of fraud, breach of contract, and securities fraud.

- Represented former partners in offshore investment bank group against remaining partners in a multi-million-dollar state complex commercial court action with claims of breach of contract, fraud, negligence, and unjust enrichment.

- Represented agricultural manufacturer against former global distributor in multimillion dollar arbitration involving breach of contract and anti-competitive claims that went to final hearing.

- Represented hydroelectric power plant owner in matter against developer and contractor of the power plant for breach of procurement engineering and construction contract.

- Represented global communications company against national telecommunications company in a multibillion dollar litigation concerning a breach of a telecommunication services contract.

- Represented national university and hospital against several hundred foreign plaintiffs alleging various human rights violations under state and federal laws.

Texas ranger

Well-Known Member

Interesting. I’ll be following this one.

Johnny Cash

Well-Known Member

So have we to wear blue next week?

Rangers International Football Club PLC (RIFC)

RIFC has raised injunction proceedings in the US to prevent a US entity and its principal falsely claiming it has been authorised by Rangers to sell shares in RIFC and using Rangers IP for that purpose.t.co

Brissy Bear

Well-Known Member

You'll be informed what to wear in due course.So have we to wear blue next week?

Might be red, white and blue with stars or without.

Johnny Cash

Well-Known Member

Thanks for the update.You'll be informed what to wear in due course.

Might be red, white and blue with stars or without.

The Shadow

Well-Known Member

Wonder if the ‘frozen’ shares that no one knew who owned are something to do with this?

Not sure what ever happened to them?

Might be the person who owns them trying to off load them?

Not sure what ever happened to them?

Might be the person who owns them trying to off load them?

keep_believin84

Official Leather Jacket Seller

Even the Yanks know Rangers is a cash cow!

They’re only here to see the Rangers.

They’re only here to see the Rangers.

Steveger

Well-Known Member

If true then Whyte would have an "over-satisfied ring" with big Bubba and his bro's waiting in the showers for him....Please, please, let it be a scam from Whyte, 99 years in a Federal penitentiary has a satisfying ring to it.

perthshireblue

Well-Known Member

This is why a 50+1 fan ownership model is so important. Given the current board members and those with larger shareholding are mostly Rangers supporters we can have some degree of trust in them, but it does not remove the risk that the club could become a plaything for some "investor" at some point in the future.

After the past ten years, we need to make sure Rangers is in safe hands.

After the past ten years, we need to make sure Rangers is in safe hands.

temperance

Well-Known Member

Ranjurs ur gawin bust.Going to wait 5 minutes until the celtic blog explains it properly.

Big Joke New

Well-Known Member

I think the whole thing is to create a negotiating position to get away tickets for Pittodrie. Smacks to me of a Bronze MyGers member stirring all this up and eventually settling for two tickets to go away.

She's a Fox.

Bluebeard

Well-Known Member

Nice Pearl NecklaceShe's a Fox.

Union bears need to get working on a song for Roland. The tune of David Watts would work.

Roland Potts | People | Foley & Lardner LLP

www.foley.com

Here's our lawyer. Roland Potts loyal.

Roland Potts is Of Counsel and Chair of the International Arbitration Team at Foley & Lardner LLP. Roland is based in the Miami office where he is a member of the Business Litigation & Dispute Practice Group. Roland has an extensive background in litigation, arbitration, and appellate matters. He has advised foreign and domestic clients across multiple industries, including construction, technology, telecommunications, energy, entertainment, agriculture, real estate, and hospitality, to name a few. Roland has counseled dozens of international clients in business and partnership dispute claims. He routinely advises multinational clients in international legal disputes and arbitral matters ranging from intellectual property disputes to breach of contract claims, anti-competitive claims, construction defects, product liability claims, and more. His experience includes litigating arbitral claims entirely in Spanish.

Representative Matters

- Represented international roofing corporation in Spanish language Panamanian arbitration against developer and general contractor of airport expansion project in a multi-million-dollar breach of contract claim.

- Represented foreign sovereign entity in multiple arbitrations across multiple countries as well a maritime attachment proceeding in the Southern District of New York against joint venture partner concerning the alleged breach of multiple contracts, successfully arguing the entity was entitled to immunity under Foreign Sovereign Immunities Act.

- Represented movie and television producer in multimillion dollar litigation dispute concerning the financing of several projects with claims of fraud, breach of contract, and securities fraud.

- Represented former partners in offshore investment bank group against remaining partners in a multi-million-dollar state complex commercial court action with claims of breach of contract, fraud, negligence, and unjust enrichment.

- Represented agricultural manufacturer against former global distributor in multimillion dollar arbitration involving breach of contract and anti-competitive claims that went to final hearing.

- Represented hydroelectric power plant owner in matter against developer and contractor of the power plant for breach of procurement engineering and construction contract.

- Represented global communications company against national telecommunications company in a multibillion dollar litigation concerning a breach of a telecommunication services contract.

- Represented national university and hospital against several hundred foreign plaintiffs alleging various human rights violations under state and federal laws.

Valley Bluenose

RTV? Completed it mate!

Our largest shareholder is seemingly 'at war' with the Board. Surely this wouldn't be Dave King?

Far fetched, I know, but this can't simply be some random trying to tout our shares surely?

Far fetched, I know, but this can't simply be some random trying to tout our shares surely?

Marty101

Well-Known Member

Liking the background averments at paragraph 7 of the Complaint:

"Founded in 1872 and based in Glasgow, Scotland, Rangers is a Scottish

professional football club that plays in the Scottish Premiership, the top division of the Scottish

Professional Football League, the league competition for men’s professional football clubs in

Scotland.

Rangers is the most successful club in Scottish football, having won the Scottish League

title 55 times, the Scottish Cup 34 times, and the Scottish League Cup 27 times. With more than

600 Rangers supporters’ clubs in 35 countries worldwide, Rangers has one of the largest fan bases

in world football."

I predict that Miami District Court is about to receive a deluge of emails from "Scottish Legal Experts" who live in their parents' basement...

"Founded in 1872 and based in Glasgow, Scotland, Rangers is a Scottish

professional football club that plays in the Scottish Premiership, the top division of the Scottish

Professional Football League, the league competition for men’s professional football clubs in

Scotland.

Rangers is the most successful club in Scottish football, having won the Scottish League

title 55 times, the Scottish Cup 34 times, and the Scottish League Cup 27 times. With more than

600 Rangers supporters’ clubs in 35 countries worldwide, Rangers has one of the largest fan bases

in world football."

I predict that Miami District Court is about to receive a deluge of emails from "Scottish Legal Experts" who live in their parents' basement...

That's a very interesting read, mostly because it is rare you get such in-depth detail on our Directors' correspondence with potential investors and also the funny section about the European Investment Firm.

The woman seems like a complete chancer, she has evidently been aware of the Club from her time at Lloyds and has taken a punt in the hope of getting heavyweight investors in the US and Europe to finance a bid to buy a majority stake in the club, under the guise of being authorised by the Rangers Board.

Bennett on the face of it has done the right thing, he took the original proposal documents to the rest of the Board, declined the offer and followed up with a customary face-to-face meeting. He then confirmed the club was not for sale and sent cease and desist notices once it was known she was using our IP and trademarks to hunt for investment.

Seems an open and shut case, be interesting to see the kind of damages we are awarded.

The woman seems like a complete chancer, she has evidently been aware of the Club from her time at Lloyds and has taken a punt in the hope of getting heavyweight investors in the US and Europe to finance a bid to buy a majority stake in the club, under the guise of being authorised by the Rangers Board.

Bennett on the face of it has done the right thing, he took the original proposal documents to the rest of the Board, declined the offer and followed up with a customary face-to-face meeting. He then confirmed the club was not for sale and sent cease and desist notices once it was known she was using our IP and trademarks to hunt for investment.

Seems an open and shut case, be interesting to see the kind of damages we are awarded.

Scott McRoberts

Well-Known Member

Basically in a nutshellWhat does all that mean?

American Company approaches Rangers to buy 75% of Rangers - Rangers Say "Nope"

American Company approaches Rangers to Buy 25% of Rangers - Rangers say "Nope"

Rangers tell American company "thanks but no thanks" - End of conversation

American Company then uses all Rangers trademarks and puts out information that Rangers equity is for sale to other investors in Europe. Rangers Say "No it isn't" and forcefully tells them to stop.

American company continues to send out this information fraudulently even after a cease and desist order. Rangers sue American company

Last edited:

stillAlwaysblue

Well-Known Member

At present this is a non event. Until our board wish to sell their shares or offer placement then the club can not change hands. Seen a lot of this when I had my spell trading in London.

Anything stock market related contains non factual comments.

For me I would like to see Amazon say they are interested in taking over D S Smith as somebody some where thought that would be a good idea.

Anything stock market related contains non factual comments.

For me I would like to see Amazon say they are interested in taking over D S Smith as somebody some where thought that would be a good idea.

The thing a lot of people are missing here is this is a Delaware LLC and there are probably no assets in KRF to pay damages.That's a very interesting read, mostly because it is rare you get such in-depth detail on our Directors' correspondence with potential investors and also the funny section about the European Investment Firm.

The woman seems like a complete chancer, she has evidently been aware of the Club from her time at Lloyds and has taken a punt in the hope of getting heavyweight investors in the US and Europe to finance a bid to buy a majority stake in the club, under the guise of being authorised by the Rangers Board.

Bennett on the face of it has done the right thing, he took the original proposal documents to the rest of the Board, declined the offer and followed up with a customary face-to-face meeting. He then confirmed the club was not for sale and sent cease and desist notices once it was known she was using our IP and trademarks to hunt for investment.

Seems an open and shut case, be interesting to see the kind of damages we are awarded.

A Delaware LLC is the equivalent of an offshore company that is invariably used as a tax avoidance scheme but rarely holds any significant assets.

In this instance, I suspect there is nothing behind KRF.

The US has the temerity to criticize overseas jurisdictions for allowing people to hide/protect assets by utilizing offshore companies but condones it in Delaware.

The beneficial ownership is also hidden. It’s actually impossible to sue anyone behind a Delaware LLC as the liability is limited in the company

Last edited:

LJ50

Well-Known Member

There will be no assets there because its simply her. Any investment capital she’s raised will have gone straight into the vehicle for the transaction, all that will have gone into ”KRF Capital” is her fees and expenses. To be fair, that’s not a Delaware thing, that would have been the case wherever she’d incorporated the business.The thing a lot of people are missing here is this is a Delaware LLC and there are probably no assets in KRF to pay damages.

A Delaware LLC is the equivalent of an offshore company that is invariably used as a tax avoidance scheme but rarely holds any significant assets.

In this instance, I suspect there is nothing behind KRF.

The US has the temerity to criticize overseas jurisdictions for allowing people to hide/protect assets by utilizing offshore companies but condones it in Delaware.

Using a Delaware structure though, absolutely ensures you cannot go after the assets of the principals involved in the business.There will be no assets there because its simply her. Any investment capital she’s raised will have gone straight into the vehicle for the transaction, all that will have gone into ”KRF Capital” is her fees and expenses. To be fair, that’s not a Delaware thing, that would have been the case wherever she’d incorporated the business.

And, as you say, the investment capital goes into that category of company for tax purposes and to allow international transactions.

Texas ranger

Well-Known Member

It’s the favorite state for incorporation. I worked for a very large energy company for years and they were incorporated there. In fact, I don’t know how accurate this article is but it gives some indication of how popular the state is for business “ homes”.The thing a lot of people are missing here is this is a Delaware LLC and there are probably no assets in KRF to pay damages.

A Delaware LLC is the equivalent of an offshore company that is invariably used as a tax avoidance scheme but rarely holds any significant assets.

In this instance, I suspect there is nothing behind KRF.

The US has the temerity to criticize overseas jurisdictions for allowing people to hide/protect assets by utilizing offshore companies but condones it in Delaware.

The beneficial ownership is also hidden. It’s actually impossible to sue anyone behind a Delaware LLC as the liability is limited in the company

“What do 68% of Fortune 500 companies and 93% of all U.S.-based initial public offerings have in common? They’re all registered in Delaware—and many at the same nondescript brick building on North Orange Street.”

Annual Report Statistics - Division of Corporations - State of Delaware

Recent statistics about the State of Delaware, the Division of Corporations, and businesses large and small that decide to make Delaware their corporate home.

WDYGH

Well-Known Member

One can only imagine the mhanks’ reaction.Would be a right good laugh if we made a fortune out of it though.

WDYGH

Well-Known Member

Correct. Bunch of scum. I will never give these rats a penny of my money. They should have been allowed to go to the wallLloyds during our struggles too.

Twosignals

Well-Known Member

See she works with the best of the best, Lloyds Bank, and Duff & Phelps NAWWW!About us – KRF Capital

krfcap.com

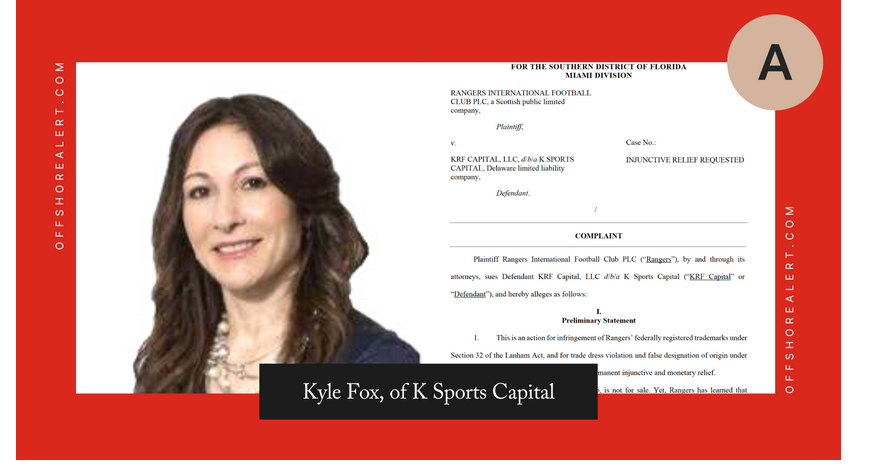

Kyle Fox

Partner

kfox@krfcap.com

Kyle has worked in capital markets for over 17 years led over $75bn of debt and equity transactions globally. Most recently she served as the Global Head of Capital Markets at HIG Capital. She founded the team and led over 60 debt financing transactions globally across their investment strategies including credit, real estate and LBO.

She has experience in sourcing and financing deal acquisitions and exits across the corporate, and real estate sector. She has work with private and public companies performing several roles including M&A advisor, investor, lender and borrower. Prior to HIG Capital, she has held various roles including at Lloyds Banking Group, Deutsche Bank and Duff & Phelps. With her wide network she manages and cultivates capital market relationships across a broad array of institutions. She has worked with leading Private Equity funds and has helped launched strong emerging funds. She has lived and worked in Asia, UK and the US.

Kyle holds a BA in Political Science and an MBA in finance from Fordham University.

PMB1872

Well-Known Member

Explains the chancer behaviour.See she works with the best of the best, Lloyds Bank, and Duff & Phelps NAWWW!

tottie beck

Well-Known Member

They’d be far better off issuing a statement about Collum

Arkanoid

Well-Known Member

Seems bizarre they even got to sit round the table with our board though, surely we’ve learned something from all thisBasically a female American Charles Green/Craid Whyte mashup

For that reason I'm out

HamiltonBear

Well-Known Member

Given that no 2 Rangers fans can agree on the colour of shite I can see some holes in your argument.This is why a 50+1 fan ownership model is so important. Given the current board members and those with larger shareholding are mostly Rangers supporters we can have some degree of trust in them, but it does not remove the risk that the club could become a plaything for some "investor" at some point in the future.

After the past ten years, we need to make sure Rangers is in safe hands.

Fan ownership is really not for us...