Not going to lie, it has always confused me as to were the sum of 74 million came from?

Is this the total amount believed to have been paid to players and directors through the ebt scheme or is it the calculated vat amount due for any ebt paym

ents made?

That figure of £74m:

Rangers paid £47.5m into EBTs 2001-2010.

HMRC decided that as staff received £47.5m net, they required a gross figure of around double this to receive the net amount. They then applied prevailing high earners rate ( which was 40% between 2001-10 ) and assessed Rangers as due approx £38m in unpaid tax.

They then applied 65% penalty on this figure of £24m and then added a further £12m interest = £74m.

In the BDO report June 2019, HMRC conceded that the £24m penalty was incorrectly applied and a further £2m was deducted as they overstated, I imagine, Whyte's non payments, so in total £26m taken off total tax bill.

As others have stated here, but is somewhat lost by many, the Times are stating that the grossing up argument used by HMRC has been incorrectly applied. If so the tax and NI due from EBTs would reduced to around £20m and the interest due would likely fall by 50%.

I would imagine, but don't know, that the rate and duration of interest charged may also be questioned by BDO.

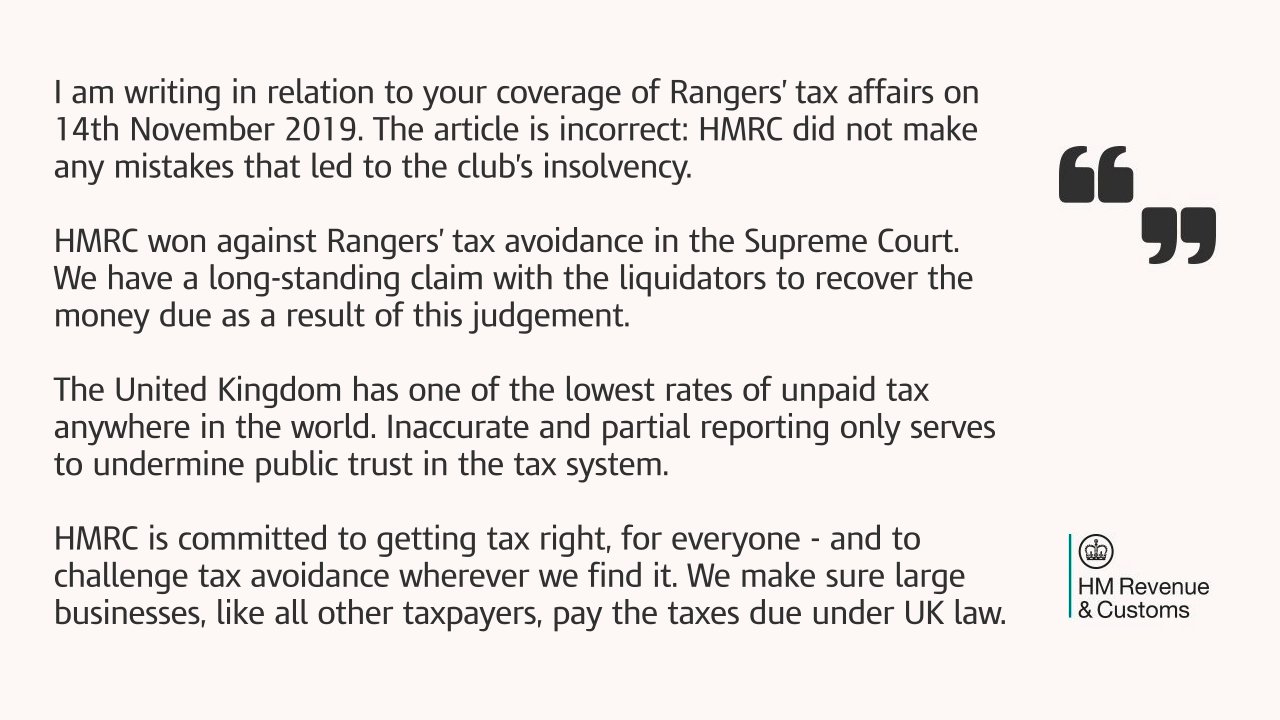

As a final point I see HMRC are tweeting tonight their tax calculations are correct, that may be so but they haven't said they correctly applied the grossing up argument that the Times claim HMRC have got wrong.

image upload site

image upload site