Exactly the point. In pursuing a crime investigation there are 3 things to look for: Motive, means and opportunity. Someone at HMRC had the means to inflate the figures, they certainly had the opportunity and there are now 2 potential motives, each of which covers a different line of questioning. 1, an individual or small group who wanted to harm Rangers specifically. or 2, an organisation that wanted to ensure as much cash was brought back as possible and that it would leave the door open for claims against 50k other people.

The only other option is that someone made a mistake with the numbers, their boss missed it, their boss missed it and countless lawyers all missed it. Tax experts from all of Britain missed it and it took 6 years for the administrators and HMRC to finally accept it. So unlikely it is bordering on the impossible.

I am swaying now towards that OBE cunto that others are going for away from Rangers. Scum boogie-men may be a red herring in this case, although I am certain that if it was the other guy, he was not exactly dissuaded by JR etc.

I would agree that there is something massively amiss in a figure being so significantly incorrect as this one was. More importantly, a primary aspect in the difficulty finding a buyer for the club was widely reported as being the uncertainty over the bill at the time - which the club obviously disputed entirely, but with HMRC's numbers in place it was a devastating value that no sane suitor would come near.

Again, it's one thing to get a number wrong. It's another entirely when they have gone through the levels of rigorous court battles to prove their case and have not recognised the claim was for amounts well above what was really owed.

However, here's probably where the wordplay around "miscalculation" kicks in. If HMRC treat "miscalculation" as about the counting up aspect in terms of tax owed, they maintain they got that correct. That's the basis of the current appeal I believe.

What they will say is that the bit they got wrong was not so much about miscalculating, it was about applying penalties on top of the tax owed that they now accept shouldn't have been applied.

Again, it's semantics, but it's something they'll argue regarding "calculations". ie The amount owed in tax was correct, IF the penalties applied, the amount owed for them was "calculated" correctly and, in turn, the interest was also "calculated" correctly. It's only once they retrospectively go back and remove the penalty aspect, that the bill comes down/numbers change.

I'm not agreeing with them, by the way, I'm simply saying I see the spin they're putting on the "miscalculation" word.

If the current appeal goes in the Oldco's favour, then I think they'll struggle to argue their position further - but they'll no doubt try it.

The question over motives and how deliberate the act was will be thrown around and debated heatedly, no doubt, however I don't think we'll see the club gain any great benefit in the long term.

My overall feeling at this stage is that the fundamental aspect behind the vilification of Rangers doesn't go away with any of this.

The faux moral outrage over tax avoidance won't be quelled, because we'll still have been found to have engaged in the same tax avoidance scheme and to have not paid tax due.

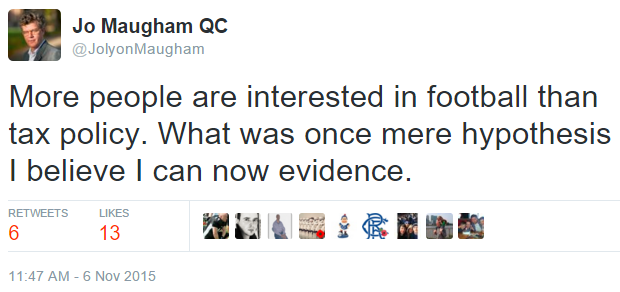

We'll never be seen as victims of anything other than our own club's actions and the media/public are never going to be interested in showing sympathy to us. Hence, I don't envisage any great political push to back us up North or South of the border as most high-profile politicians would actively shy away from siding with an organisation still found accountable for not paying tax due.